illinois payroll withholding calculator

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Early 2022 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

. Illinois Payroll Withholding Effective January 1 2022. Free Illinois Payroll Calculator. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay.

As an employer Illinois State University is required by law to withhold income and employment taxes from wages. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Using the savings from purchasing our. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. The employee should complete the Certificate of Working Outside the State of Illinois form and appropriate withholding form for their state and submit or fax to.

These calculators should not be trusted for accuracy for example to calculate precise taxes payroll or other financial info. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Make sure to use the correct version of Form IL-941 for the liability period you are filing.

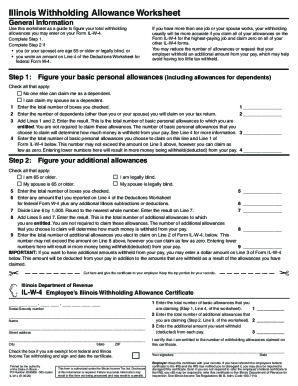

495 Basic allowance IL-W-4 line 1. Illinois state law 305 ILCS 510-162 allows for the use of a universal OrderNotice - Income Withholding for Support to be sent to employers for purposes of income withholding for child support. Supports hourly salary income and multiple pay frequencies.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

If you are married but would like to withhold at the. Ad Process Payroll Faster Easier With ADP Payroll. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Illinois withholding income tax payments are made on Form IL-501 Withholding Payment Coupon and Illinois withholding is reported on Form IL-941 Illinois Withholding Income Tax Return. Federal and Illinois Paycheck Withholding Calculator. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. This estimator could be employed by nearly all taxpayers. If you wish to calculate your salary for another state you can choose and alternate salary calculator here.

Use tab to go to the next focusable element. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that goes on Federal tax and Illinois State tax. Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right.

Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Take a free trip to Europe -- every year. This free easy to use payroll calculator will calculate your take home pay.

Free Federal and Illinois Paycheck Withholding Calculator. All you have to do is enter wage and W-4 information for each employee and our calculator will process your gross pay net pay and deductions for federal taxes as well as Illinois state taxes. Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right.

2022 Federal Tax Withholding Calculator. Illinois Salary Paycheck Calculator. If you have questions call the Payroll Office at 309 438-7677 or e-mail payrollilstuedu.

This tax calculator helps you identify just how much withholding allowance or extra withholding should be documented in your W4 Form. This procedure only applies to nonresident alien employees who have wages subject to income tax withholding. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

Occupational Disability and Occupational Death Benefits are non-taxable. Marshfield Ave M-C 547. The federal government requires all states to use a universal form Federal Income Withholding For Support form.

How Your Paycheck Works. Neither these calculators nor the suppliers and affiliates thereof are providing taxes or legal suggestions. 2022 Federal Tax Withholding Calculator.

Discover ADP For Payroll Benefits Time Talent HR More. Illinois Hourly Paycheck Calculator. Illinois withholding effective January 1 2021 Federal withholding tax table Paycheck Calculator Paycheck Withholding Changes Withholding Tax Primer.

Get Started With ADP. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This is a projection based on information you provide.

University Payroll and Benefits. Withholding refers to income and employment taxes withheld from wages by employers. Paycheck Calculator The tax withholding estimator 2021 permits you to definitely determine the federal income tax withholding.

This is a calendar year form and each year has its own. Thursday Friday June 16 17 for our two-day seminar and Annual Members Meeting.

Illinois Paycheck Calculator Smartasset

The Caucus Blog Of The Illinois House Republicans Calculating Estimated State Taxes During Covid 19 Pandemic

Payroll Software Solution For Illinois Small Business

Illinois Minimum Wage 2022 Increase Eder Casella Co Certified Public Accountants

The Illinois Fair Tax Explained Levenfeld Pearlstein Llc

Should My Long Term Disability Benefits Be Taxed I

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Destination Based Sales Tax Assistance Effective January 1 2021 Sales Taxes

2020 2022 Form Il Il W 4 Fill Online Printable Fillable Blank Pdffiller

Solved Illinois Schedule Cr Credit For Taxes Paid To Ot

Illinois Minimum Wage Increasing In January Eder Casella Co Certified Public Accountants

What Is A Fair Tax For Illinois Seiu Local 73

Retirement Withdrawal Tax In Illinois

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings